This is about connecting—through ideas, visions, or shared experiences.

So here I am again, pen in hand, trying to reconnect with some of my darker theories.

I’ve got no plans to change, even after taking a few hits.

Which is exactly why I’m going to keep sharing where my thinking’s headed.

Some of you have probably noticed I’ve been writing more and more about metals lately—especially silver and gold.

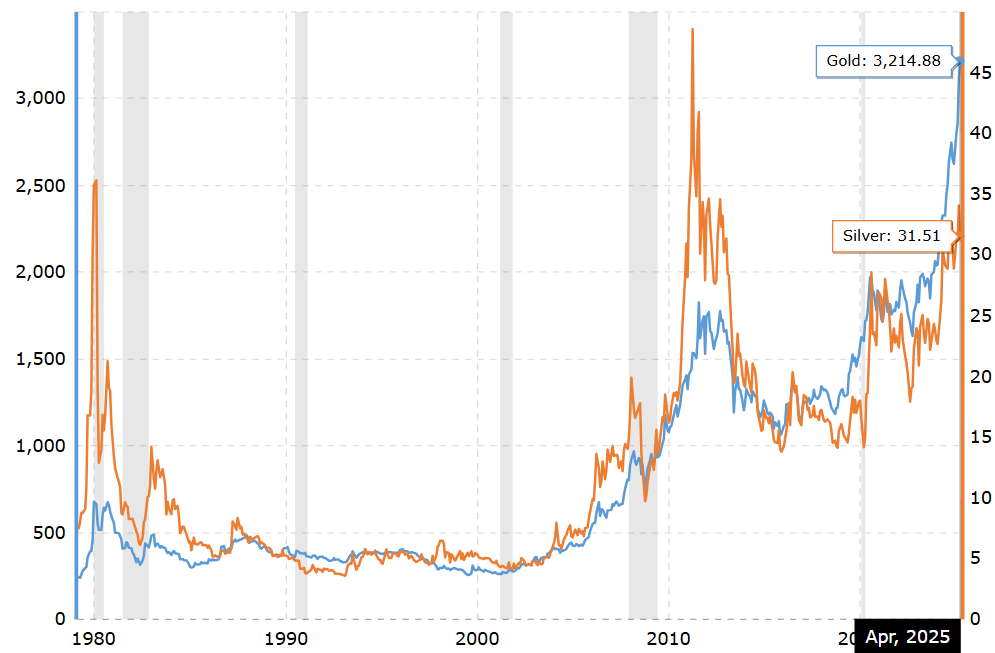

I genuinely believe we’re on the verge of a historic breakout in the gold and silver markets.

What’s happening with silver prices is nothing short of blatant manipulation.

As I’ve said before, banks like JPMorgan are holding massive short positions—equivalent to around a quarter of global annual silver production.

It’s all paper. No physical backing. And that can’t go on forever. (Or maybe it can… until it doesn’t.)

So yeah, at some point, the whole thing’s going to blow.

And trust me, I don’t love being that guy sounding the alarm, but this house of cards is collapsing under its own weight.

People are throwing out numbers—$50 silver, $80 silver… even higher, if the physical market demands actual delivery.

The COMEX system (paper silver futures) is on life support.

Vaults are being drained. Banks are turning to desperate tactics like “reverse arbitrage”—importing expensive silver from abroad just to sell it cheap in the U.S. and keep prices from taking off.

Even BlackRock’s interest in the Sprott Physical Silver Trust (PSLV) shows the big players are sniffing out real coverage—not paper exposure.

Add to that the explosion in industrial demand—from:

Solar panels

High-volume electronics (smartphones, laptops)

EVs (electric vehicles)

5G networks and antennas

And yeah, we might be standing right at the start of a new bull cycle in precious metals.

Only this time, I don’t think there’s a way back.

That’s why, of course, part of Portfolio360 is exposed to real assets—real as in “you can actually hold them in your hand.”

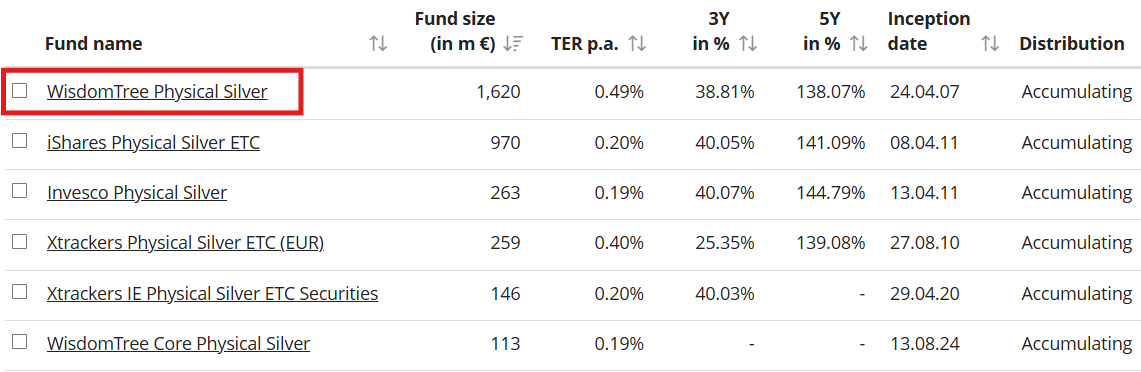

There are also a bunch of ETCs (Exchange Traded Commodities) that give you exposure to physical silver. We’re talking millions of ounces stored across giant vaults—mostly under HSBC Bank PLC as custodian, typically in London.

I’ll drop a random list of them for you. You’ll find the approximate weight of each bar and who’s managing the vault.

For me, this is the only way I see to shield part of my wealth from what could very well be a full-blown reset.